maine excise tax credit

Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara. The bureau shall grant to the wholesale licensee a credit of all state excise tax paid in connection with that sale under the following conditions.

Rebates And Tax Credits For Electric Vehicle Charging Stations

Income Tax Credits Individual income tax credits provide a partial refund of property tax andor rent paid during the tax year.

. The calculator below will help give you an idea of what it will cost to renew the current registration on your passenger vehicle. Please note this is only for estimation purposes -- the exact cost will be determined by the city when you register your vehicle. Except for a few statutory exemptions all vehicles registered in the State of Maine are subject to excise tax.

Tax Relief Credits and Programs. Maine residents that own a vehicle must pay an excise tax for every year of ownership. Alternate formats can be requested at 207 626-8475 or via email.

The excise tax due will be 61080. Where do I pay the excise tax. Excise tax is an annual local town tax paid at the Town Hall where the the vehicle resides for over six 6 months of the year.

Knowingly supplying false information on this form is a Class D Offense under Maines Criminal Code punishable by confinement of up to one year or by monetary fine of up to 2000 or by both. Maine Revenue Services administers several programs aimed at providing eligible Maine taxpayers with tax relief. 2020 - 2022 Tax Alerts.

Excise Tax Calculator This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle. Please sign and date in. 1 The bureau shall grant a credit for the excise tax on malt liquor or wine sold by wholesale licensees to any instrumentality of the United States or any Maine National Guard state training site exempted by the bureau.

This calculator is for the renewal registrations of passenger vehicles only. - NO COMMA For new vehicles this will be the amount on the dealers sticker not the amount you paid. An owner or lessee who has paid the excise tax in accordance with this section or the property tax for a vehicle is entitled to a credit up to the maximum amount of the tax previously paid in that registration year for any one vehicle toward the tax for any number of vehicles regardless of the number of transfers that may be required of the owner or lessee in that registration year.

AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes. To view PDF or Word documents you will need the free document readers. In this case the total selling price of your vehicle comes out to 8000.

Online calculators are available but those wanting to figure their excise tax in Maine can do so easily using a manual calculator or paper and pen. You must always come to Town Hall first to. Enter your vehicle cost.

Excise Tax is an annual tax that must be paid prior to registering your vehicleExcept for a few statutory exemptions all vehicles including boats registered in the State of Maine are subject to the Excise TaxExcise Tax is defined by State Statute as a tax levied annually for the privilege of operating a motor vehicle boat or camper trailer on the public ways. The Maine EIC is available to Maine individual income tax taxpayers who properly claim the federal earned income tax credit on federal Form 1040 or Form 1040-SR or who are otherwise eligible to claim the federal credit except that they filed a federal individual income tax return using an IRS-issued Individual Taxpayer Identification Number ITIN or had no qualifying. An excise tax credit accrues for each vehicle excise tax paid in the prior completed period for which the associated Maine registration was surrendered prior to the expiration of the associated 12-month excise tax period unless the excise tax was credited to another registration in which case the 12-month period continues to run in association with the replacement registration.

Narratives IFTAIRP Propane Tax. The State of Maine will reimburse Municipalities for the difference between the excise tax based on the sale price and the Manufacturer Suggested Retail Price MSRP on vehicles that are 1996 or newer and registered for a gross weight of more than 26000 lbs. How much is the excise tax.

I have entered this info in Federal Taxes under deductions and credits. That now includes buses manufactured 2006 and newer. A registration fee of 3500 and an agent fee of 600 for new vehicles will also be charged for a total of 64180 due to register your new vehicle.

An owner or lessee who has paid the excise or property tax for a vehicle the ownership or registration of which is transferred or that is subsequently totally lost by fire theft or accident or totally junked or abandoned in the same registration year is entitled to a credit up to the maximum amount of the tax previously paid in that registration year for any one vehicle toward. Excise Tax Credit Summary Report. Like all states Maine sets its own excise tax.

When it comes down to Maines sales tax on cars youre only taxed on the 5000 credit not the 13000 you bought it for. Excise Tax Credit Summary Report Rev. Excise tax is defined by Maine law as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways.

Excise tax is paid at the local town office where the owner of the vehicle resides. When a vehicle needs to be registered an excise tax is collected prior to the registration. We administer the real estate transfer tax commercial forestry excise tax controlling interest transfer tax and telecommunications business equipment tax and we determine annually the amount of tax reimbursement to each town for veteran homestead and animal waste facility exemptions and tree growth tax loss reimbursement.

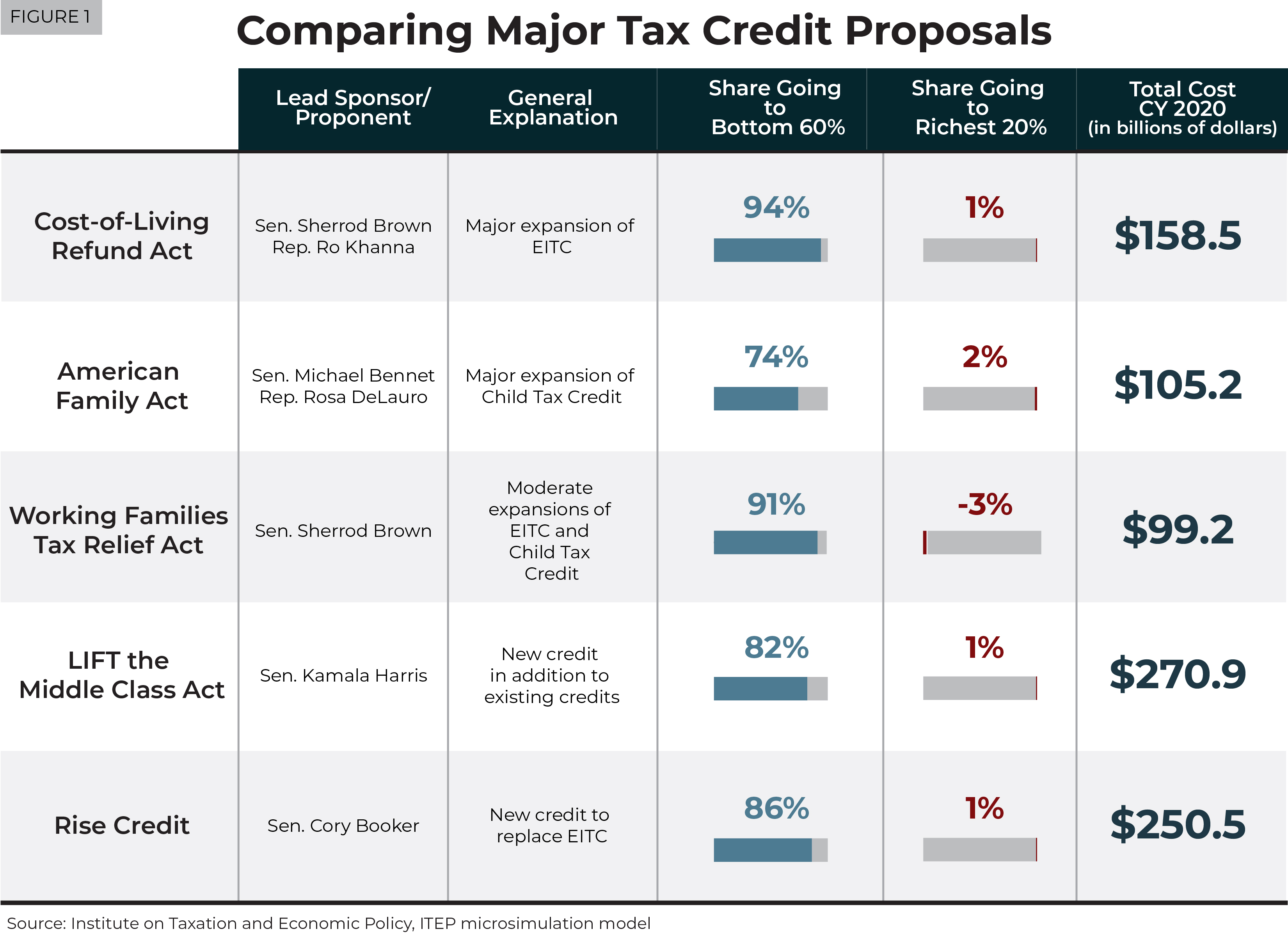

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

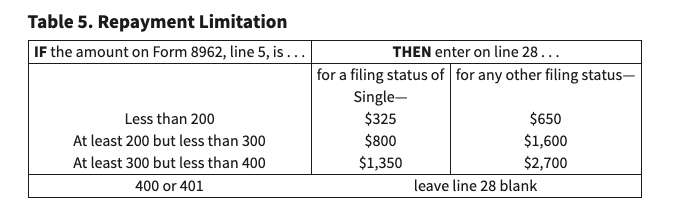

Advanced Tax Credit Repayment Limits

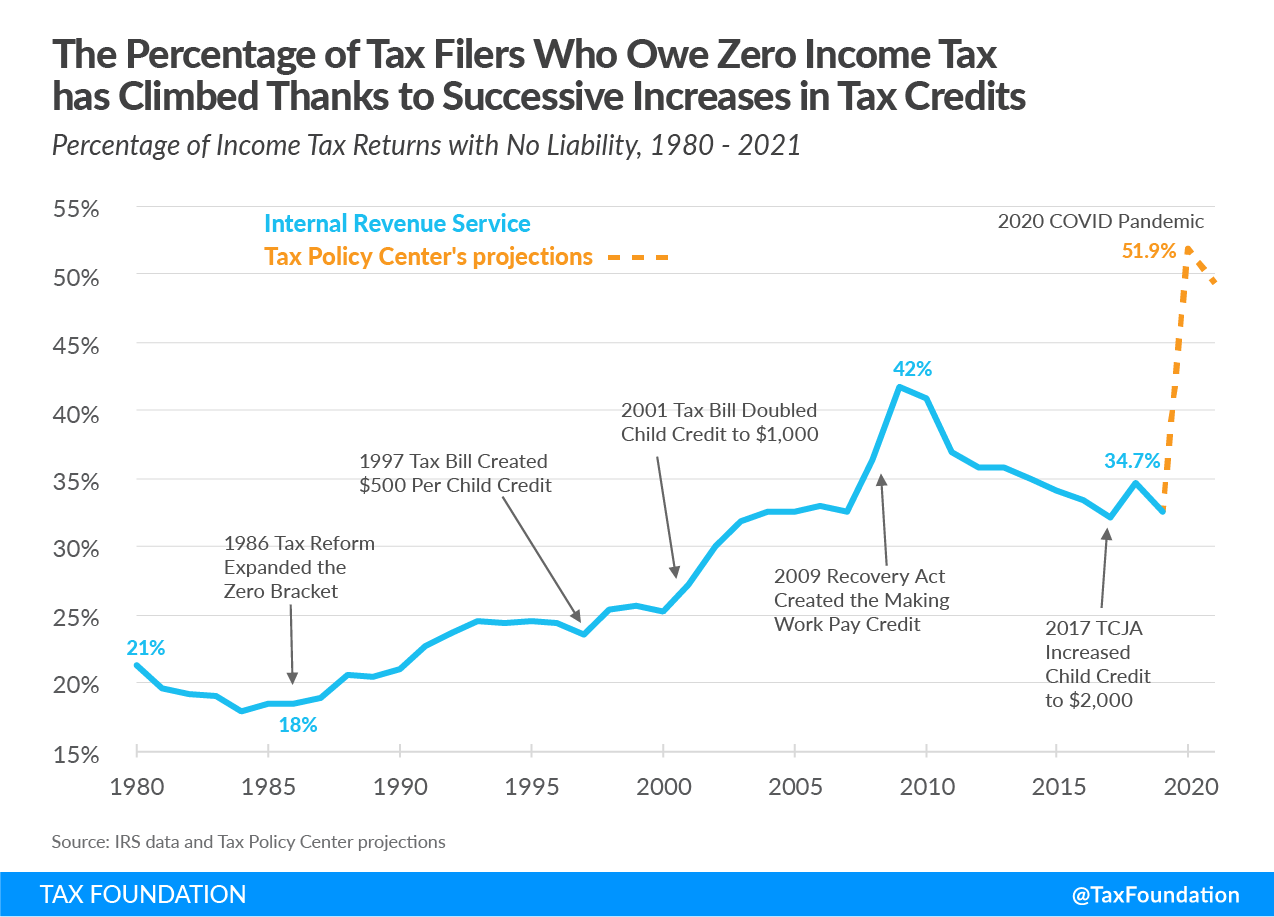

Increasing Share Of U S Households Paying No Income Tax

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Deducting Property Taxes H R Block

Child Tax Credit January 2022 When Could Ctc Payments Start In 2022 Marca

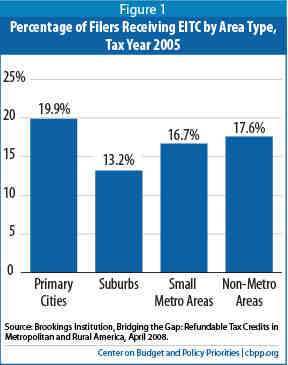

A Hand Up How State Earned Income Tax Credits Help Working Families Escape Poverty In 2011 Center On Budget And Policy Priorities

Breaking Down The Craft Beverage Modernization And Tax Reform Act Blue Label Packaging Company

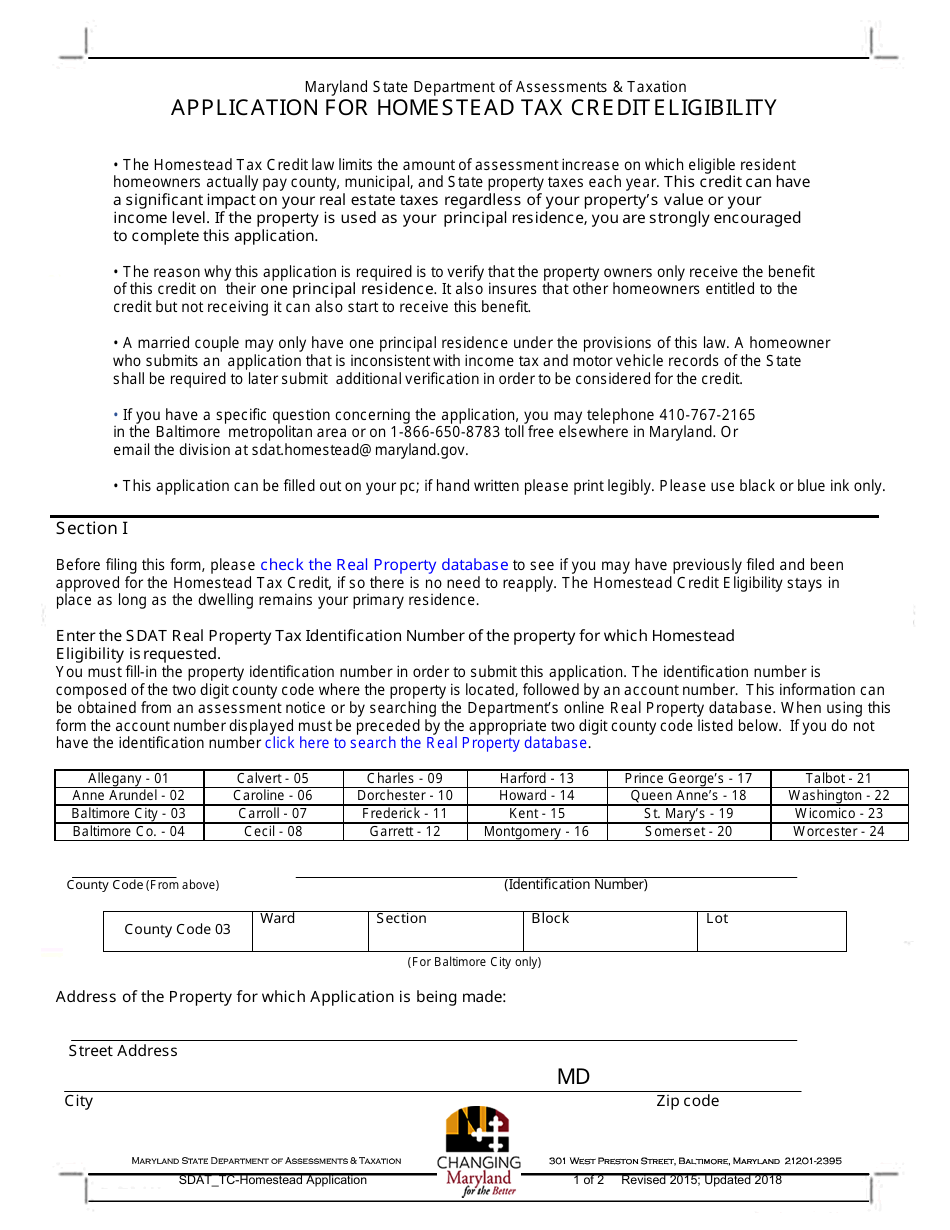

Maryland Application For Homestead Tax Credit Eligibility Download Fillable Pdf Templateroller

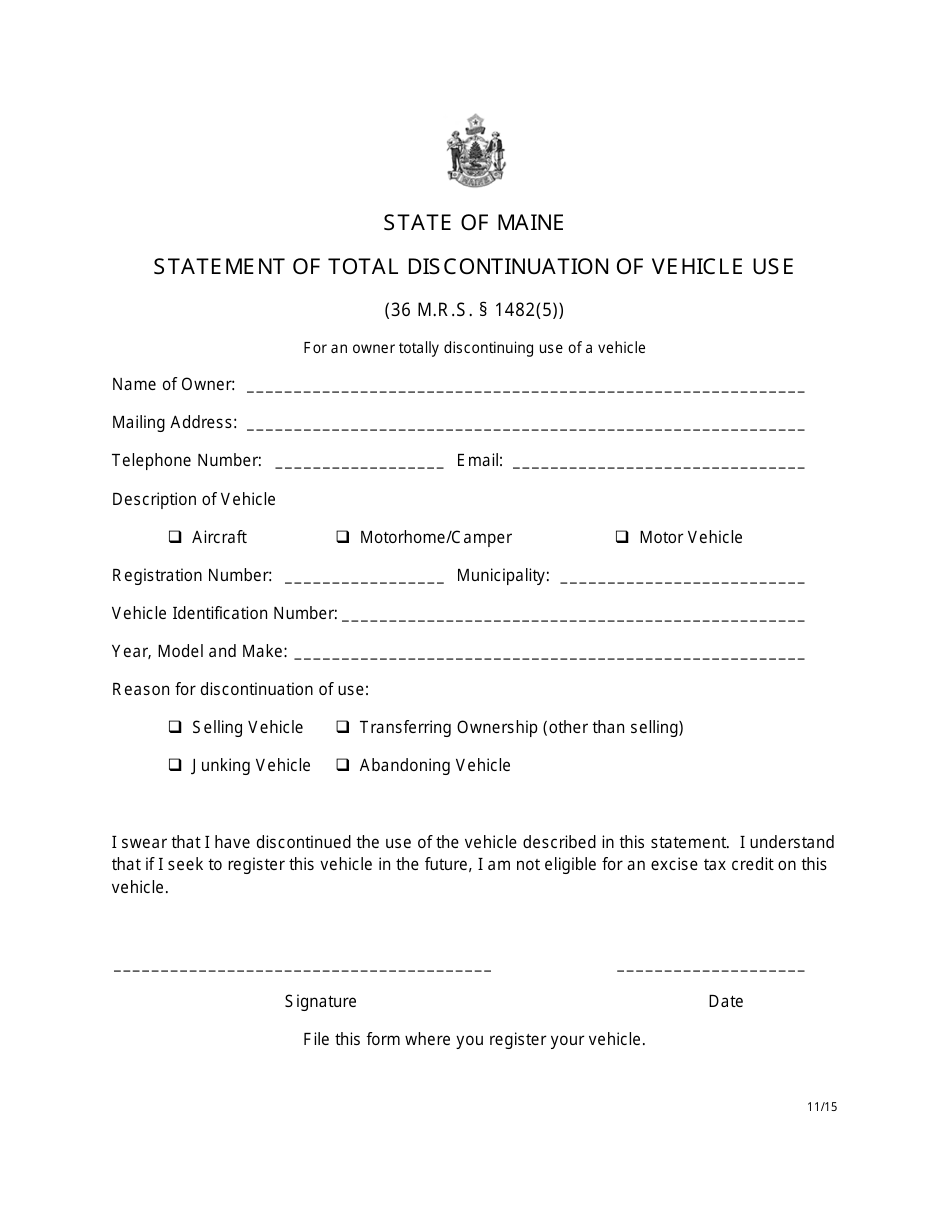

Maine Statement Of Total Discontinuation Of Vehicle Use Download Printable Pdf Templateroller

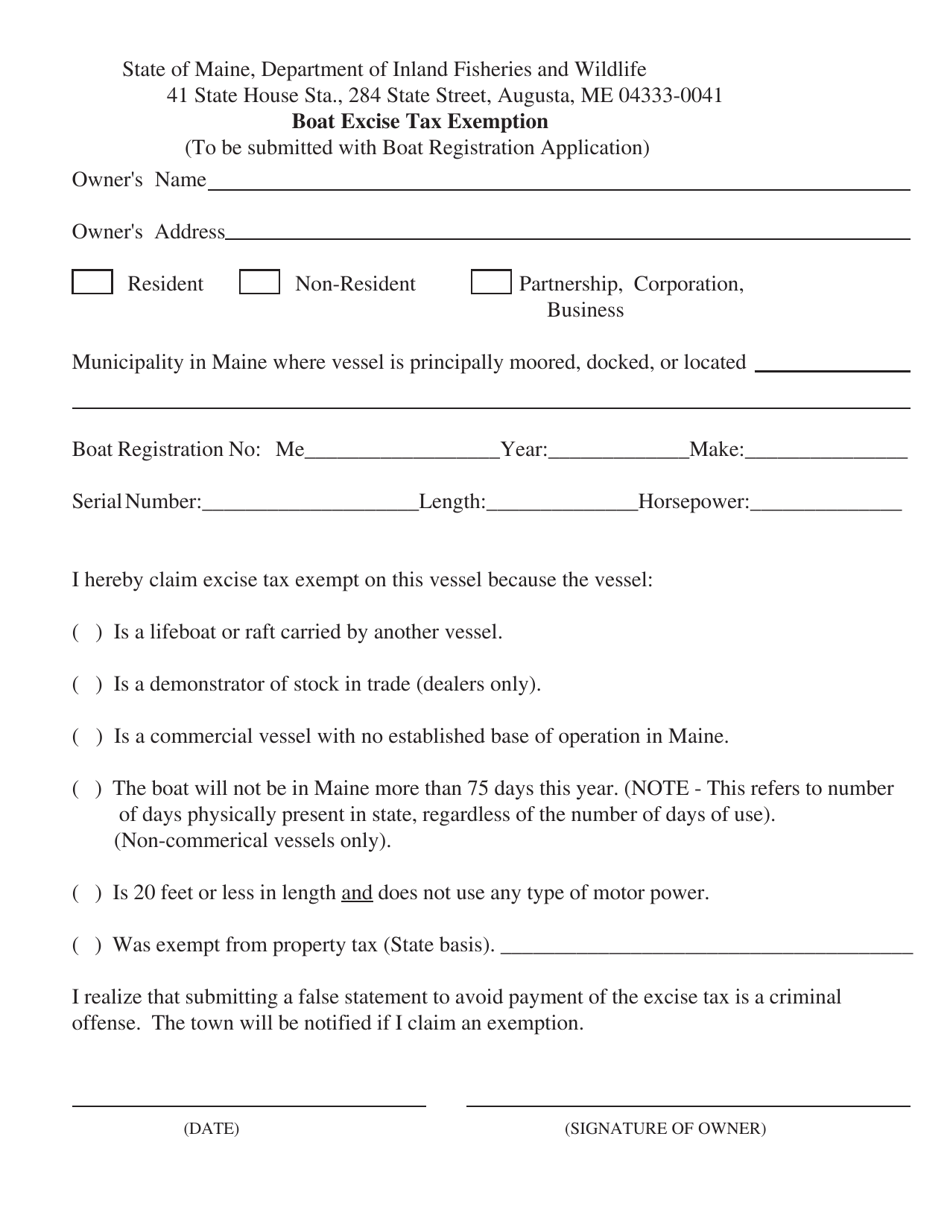

Maine Boat Excise Tax Exemption Download Printable Pdf Templateroller

The Main Hope Of A Nation Lies In The Proper Education Of Its Youth Erasmus Youthday Nationalyouthday Aspireinstitute Education Youth Day National

New Itep Estimates On Biden S Proposal To Expand The Child Tax Credit Itep

Increasing Share Of U S Households Paying No Income Tax

The Problem With Returning To A 2 000 Non Refundable Child Tax Credit Itep

Proposals For Refundable Tax Credits Are Light Years From Tax Policies Enacted In Recent Years Itep

These Are The States Whose Residents Pay The Highest Taxes Income Tax Tax Refund Income Tax Return

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog